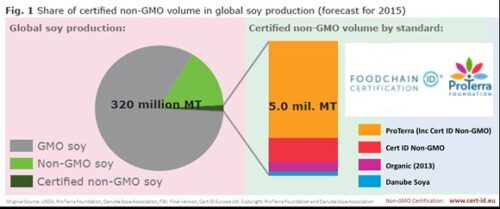

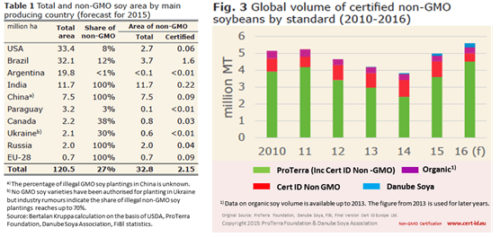

According to a 2015 report by ProTerra & Danube, in terms of volume, Non-GMO soy certification and verification is dominated globally by the FoodChain ID Non-GMO and ProTerra standards, together covering 91% of the market (Fig. 1). The report states that production of certified soybeans under the FoodChain ID Non-GMO Standard are expected to expand by around one-third to 4.5 million MT in 2015. Brazil’s forecasted soy bean growth is responsible for the biggest share of the volume, with 4.0 million MT of FoodChain ID Non-GMO certified soybeans to hit the market. India is also likely to play an important role in the export of Non-GM certified soy (400,000 MT) in 2015. A large part – around 80% – of the FoodChain ID Non-GMO volume meets sustainability criteria, and is likewise certified under the ProTerra Standard. The ProTerra standard cannot be attained without FoodChain ID Non-GMO certification.

Non-GMO Soy Market Facts:

- Global production of soybeans was 341.67 million metric tons for 2017-2018. Non-genetically modified (non-GMO) soybeans is estimated at 43 million metric tons (MT) in 2017-18, 13% of the total soy output (inferences based on WASDE report of April 9, 2019 and market information).

- Out of this, around 4.0 million MT of soybeans are expected to be segregated along the food chain and certified according to non-GMO standards.

- The volume of certified non-GMO soybeans is predicted to remain stable in 2019 and expand by in 2020 due to market changes.

- The demand in the non-GMO soy volume is fuelled by retailers throughout Europe – especially in Germany, Austria and Switzerland, but also France, Italy, and Poland – that require non-GMO reared animal products. The aquafeed sector in Scandinavia also contributes to this demand.

- Non-GMO standards in the sector include the market leader FoodChain ID Non-GMO and ProTerra standards, together covering 91% of the certified volume.

- Certified non-GMO soy production is concentrated in Brazil, forming 80% of the total volume although India and Europe are playing an increasing role in this area.

The FoodChain ID Non-GMO status has value within the soy market.

In some regions – especially in Europe – consumers prefer non-GMO foods due to environmental and health concerns associated with GMOs. Hence, a market segment has developed for products with guaranteed non-GMO origins. However, food producers often face challenges in this area because of the limited availability of GMO-free soy raw material in the global market.Global soy production is projected to cover 120.5 million hectares in 2015, yielding a harvest of around 320 million MT. GMO seeds are largely used worldwide. In fact, close to three-quarters of the global soy area is planted with biotech varieties. The technology is most popular in the top three soy producing and exporting countries, namely the USA, Brazil and Argentina (Table 1). The extensive use of GMOs leaves limited options for non-GMO soy production, and need for proof via FoodChain ID Non-GMO Certification of Non-GMO soy (Fig 3).